ISF 10+2 Filing Guide for China–U.S. Ocean Shipments (Ecommerce)

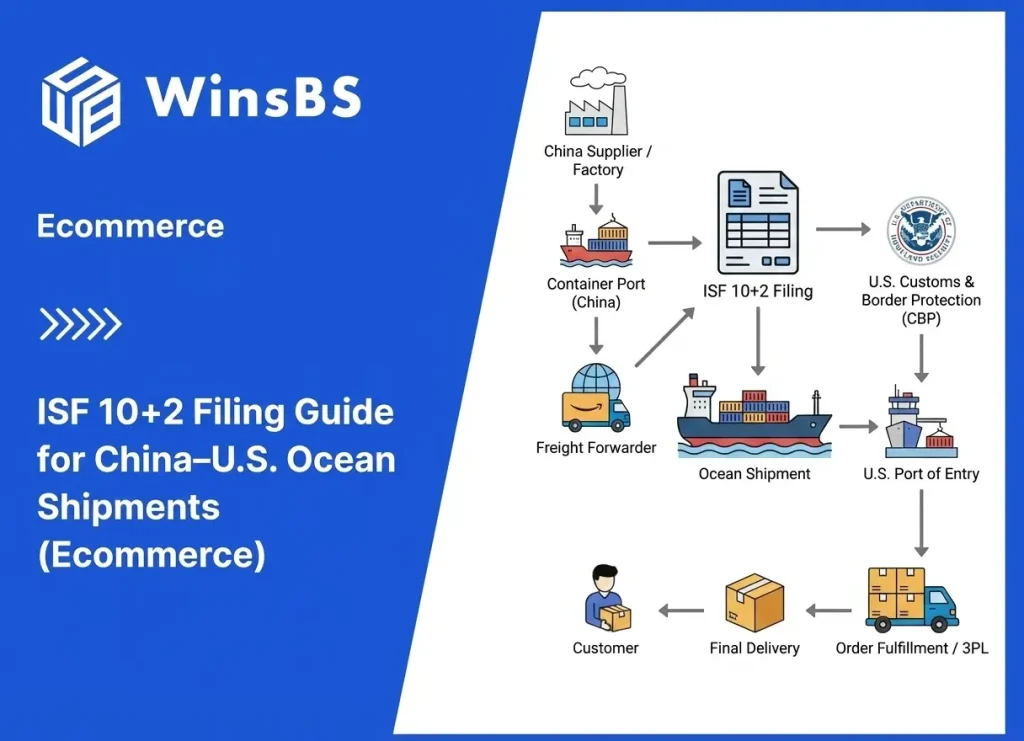

ISF 10+2 Filing Guide for China–U.S. Ocean Shipments A Fulfillment-First Playbook for Ecommerce Inventory, FBA Inbound Timing & U.S. Port Hold Avoidance WinsBS Research – Michael Updated December 2025 TL;DR Importer Security Filing (ISF 10+2) is an advance cargo security filing required for U.S.-bound ocean freight. In ecommerce, ISF is not “customs paperwork.” It is a fulfillment gate: if ISF data is late, inconsistent, or amended after vessel loading, inventory may be physically at a U.S. port while still being operationally blocked—causing FBA check-in delays, inventory availability gaps, missed inbound appointments, and lost sales windows. Official CBP overview: Importer Security Filing “10+2”. This article is written for ecommerce operators shipping from China to the United States by ocean freight, including Amazon FBA sellers, direct-to-consumer (DTC) brands, and crowdfunding teams. It explains how ISF interacts with purchase orders, factory data, booking discipline, and warehouse receiving—so your inventory becomes sellable on time, not “arrived but unusable.” If you want an inbound workflow check (data discipline, cross-border readiness, inbound scheduling), Get Started for Free or contact the team: Talk to WinsBS. If your China–U.S. ocean shipment is showing “Arrived” but: Amazon FBA inbound cannot be checked in Inbound appointments keep getting pushed out Your 3PL says the container cannot be released yet then the issue is often not port congestion and not warehouse capacity. In ecommerce fulfillment, the missing control is frequently Importer Security Filing (ISF 10+2)—specifically, whether the inbound data story was stable before vessel loading. Contents Fast Answers: ISF 10+2 for Ecommerce Why Ecommerce Shipments Say “Arrived” but Fulfillment Has Not Started What Is Importer Security Filing (ISF 10+2)? ISF as a Fulfillment Gate (Not a Customs Form) FBA vs DTC vs Crowdfunding: How ISF Failure Breaks Each Model Importer of Record Responsibility in Ecommerce Structures ISF-10 Data Elements Explained with Ecommerce Data Sources The “+2” Carrier Data Elements: What Sellers Must Still Watch ISF Timeline: What “24 Hours Before Loading” Actually Means FCL vs LCL vs Multi-SKU: Where ISF Risk Explodes High-Frequency ISF Failure Modes (Case Cards) ISF Penalties vs Fulfillment Loss: The Real Cost Model ISF vs AMS vs Customs Entry — Fulfillment Control Comparison Fulfillment-First ISF Checklist (Copy/Paste) People Also Ask: Short Answers Final Recommendation: Build ISF Into Inbound Execution FAST ANSWERS: ISF 10+2 FOR ECOMMERCE What is Importer Security Filing (ISF 10+2)? Importer Security Filing (ISF 10+2) is an advance security filing required for U.S.-bound ocean freight. It requires ten importer-provided data elements and two carrier-provided data elements to be submitted to U.S. Customs and Border Protection before vessel loading. Official CBP overview: ISF 10+2. When must ISF be filed? ISF is generally required no later than 24 hours before cargo is loaded on the vessel at the foreign port. Do not interpret this as “24 hours before the ship departs.” CBP help article: When to submit ISF. Why do ecommerce sellers feel ISF problems at FBA check-in or warehouse receiving? Because ISF is a pre-fulfillment gate. If ISF data is late, inconsistent, or amended after vessel loading, the shipment may be flagged for review and operationally delayed at the exact moment you need to schedule drayage, inbound appointments, and inventory availability. Who is responsible for ISF in practice? The Importer of Record (and/or the ISF importer depending on cargo type and filing structure) bears responsibility. A freight forwarder or customs broker may transmit the filing, but responsibility and downstream fulfillment risk do not disappear. Reference: CBP ISF FAQ: ISF 10+2 FAQs Download CBP FAQs PDF. What is the most common ecommerce ISF mistake? Treating ISF as “broker paperwork” instead of inbound execution data—especially inaccurate manufacturer identity, inconsistent ship-to party, and last-minute amendments after vessel loading. WHY ECOMMERCE SHIPMENTS SAY “ARRIVED” BUT FULFILLMENT HAS NOT STARTED China → U.S. ocean freight in ecommerce has a recurring failure pattern: the container is physically present at a U.S. port, but the business experiences the shipment as if it is “missing.” This is not a contradiction. It is a system mismatch. Ecommerce fulfillment does not start when a vessel arrives. Fulfillment starts when inventory becomes operationally usable: when drayage can be scheduled, inbound appointments can be confirmed, receiving can be executed, and the inventory record can be trusted. If any upstream control blocks those actions, you get the most frustrating state in cross-border logistics: arrived but unusable. Many sellers misdiagnose this state as port congestion, warehouse capacity, or “random inspection.” Those can be real contributors, but for ecommerce shipments the decisive root cause is often the same: the inbound data that proves identity, origin, and routing was not stable at the moment ISF needed it. In other words, the problem is not the container. The problem is the inbound proof that the container should be allowed to flow into the fulfillment system. Fulfillment-first framing: ISF 10+2 is not a form that “finishes customs.” It is a control that helps determine whether your shipment can proceed to appointment booking, receiving, and inventory availability without disruption. WHAT IS IMPORTER SECURITY FILING (ISF 10+2)? Importer Security Filing (ISF 10+2) is an advance cargo security filing required for non-bulk cargo shipments arriving in the United States by vessel. It requires the electronic transmission of specific data elements to U.S. Customs and Border Protection (CBP) prior to vessel loading. CBP’s official program page provides the baseline definition and scope: Importer Security Filing “10+2”. From a fulfillment execution perspective, Importer Security Filing (ISF 10+2) functions as a pre-entry control gate rather than a customs form. If the ISF data story is unstable at loading time, downstream inbound execution becomes unpredictable—even when the vessel arrives on schedule. “10+2” means: 10 data elements provided by the importer (or the importer’s nominated agent) that describe the seller-buyer relationship, factory identity, origin, classification, and consolidation details. 2 data elements provided by the ocean carrier: vessel stow plan data and container status messages. ISF applies to U.S.-bound cargo by vessel, including shipments moving to U.S. ports for direct discharge as well as certain transit cargo structures depending on the filing