Top 10 Best 3PL Solutions for Apparel Brands (2025)

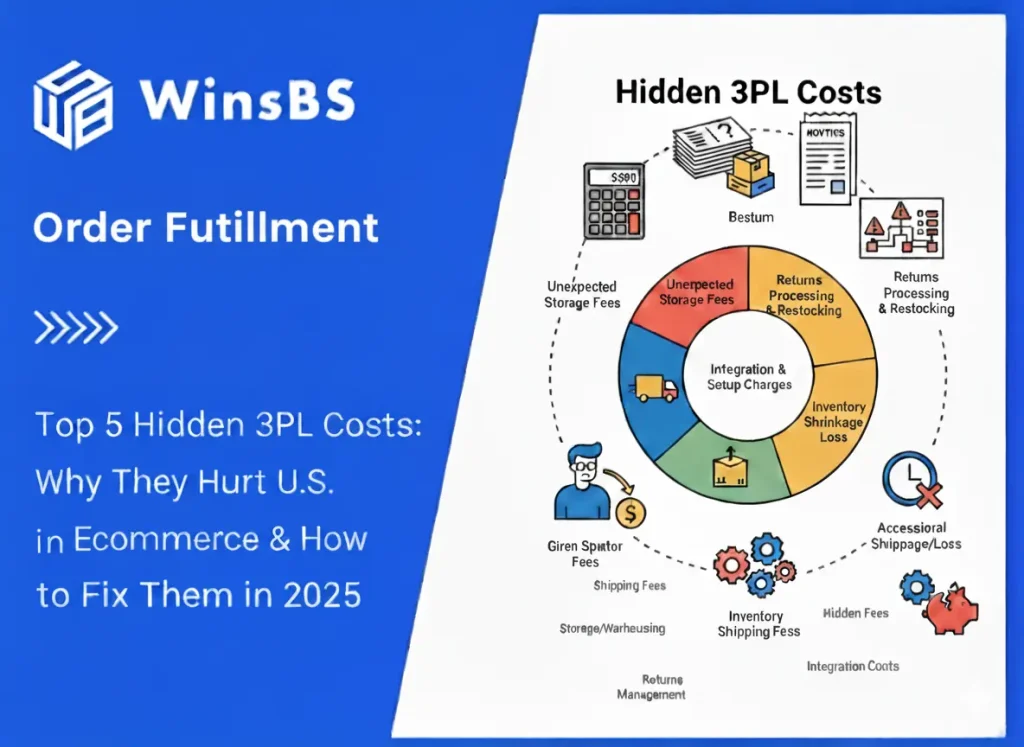

Best 3PL Solutions for Apparel Brands (2025) Global Fulfillment Partners for Fashion, DTC & Emerging Labels WinsBS Fulfillment Research Team – Maxwell Anderson November 2025 In 2025—a pivotal year for e-commerce supply chain transformation—the global e-commerce market has surged to $4.8 trillion. For apparel brands—the backbone of the fashion industry—this growth brings unprecedented opportunities and critical challenges, especially for U.S. startups and SMBs (small to medium-sized businesses) competing in apparel fulfillment and logistics. The core conflict? Traditional supply chains can’t keep up with e-commerce’s “right now” demands. American shoppers expect 2-day lightning delivery—but all too often, they’re let down by stockouts, piled-up returns, or rising cross-border tariffs. According to 2025 data, tariff hikes have increased per-unit landed costs by 8–15%, leaving small and mid-sized apparel brands struggling to maintain profit margins while ensuring reliable apparel order fulfillment. Compounding the issue: the 3PL market is crowded, yet riddled with hidden fees and one-size-fits-all solutions that fail to address apparel’s unique needs—think GOH (garment-on-hanger) storage, high-SKU complexity, seasonal order spikes, and reverse logistics for returns. For fashion and apparel brand owners, finding a 3PL partner specialized in apparel fulfillment has become a costly, time-consuming hurdle. That’s why we’ve written this article. It’s built for U.S. e-commerce entrepreneurs and apparel SMBs—designed to cut through the noise and connect you with 3PL solutions for apparel brands that actually fit your business needs—no guesswork required. Why now? 2025 is a turning point for apparel logistics and 3PL digitization: industry research shows e-commerce brands using 3PLs achieve over 99% order accuracy, 40% faster delivery times, and a 25% boost in customer retention. Today, 37–60% of U.S. apparel brands already outsource their fulfillment operations to scale globally—and the gap between those who do (and thrive) and those who don’t is widening. Built on insights from WinsBS Research’s 2025 Fulfillment Study (Apparel Section), this report identifies apparel-specific challenges—GOH handling, multi-channel integration, and seamless return management. Whether you’re a new brand with low order volumes or a growing mid-sized label, you’ll find scalable apparel fulfillment solutions to minimize costs, reduce risk, and build sustainable growth. Let’s dive in. Apparel 3PL Selection Methodology A data-driven framework helping U.S. apparel and fashion brands identify 3PL partners that truly align with their operational DNA — built from WinsBS Research’s 2025 Apparel Fulfillment Study. 1. Core Principle — Fit → Specialization → Sustainability Selecting a 3PL for apparel fulfillment isn’t just about cutting costs; it’s about ensuring alignment, technical depth, and long-term scalability. WinsBS Research recommends a three-tier decision logic designed for apparel and DTC brands: Fit: Can we realistically operate together within capacity and systems? Specialization: Does the provider understand apparel logistics and SKU diversity? Business & Sustainability: Can the partnership grow responsibly and adapt to future shifts? 2. Apparel Supply Chain Challenges & Required 3PL Capabilities Apparel fulfillment faces unique complexities—seasonality, SKU variation, and high return volumes. The following matrix maps the top five challenges against the 3PL capabilities essential for sustainable growth. Supply Chain Challenge Typical Manifestation Required 3PL Capability High SKU complexity Multiple colors and sizes per style; SKU explosion WMS with multi-attribute SKU support, smart replenishment, AI demand forecasting, and oversell prevention Seasonal volatility Sharp peaks during Spring/Summer & Fall/Winter campaigns Elastic warehousing and staffing, short-term scalability, AI-driven inventory allocation High return rates (especially DTC) 20–40% return rate typical in fashion sector Robust reverse logistics: grading, QC, refurbishment & restock; visualized returns reporting and resale loop Omnichannel complexity Shopify, Amazon, wholesale, and retail operations overlap Unified OMS routing, hybrid B2B/B2C integration, EDI & cross-border data sync Diverse product forms GOH hanging, flat-packed, steamed, or custom-packaged garments Dedicated hanging zones, climate-controlled storage, tag printing, steaming line, and secure high-value areas 3. Three-Step 3PL Evaluation Model (Weighting: 35% / 40% / 25%) ① Fit — Entry Threshold & Network Coverage (35%) Does the 3PL accept small-to-mid-volume or scaling apparel brands? Warehouse network coverage (U.S., cross-border, Asia, EU)? System compatibility: Shopify, Shopline, Amazon, ERP (NetSuite, Brightpearl)? Supports hybrid DTC + B2B models and customs clearance processes? ② Specialization — Apparel Industry Expertise & Technical Capability (40%) Supports GOH hanging, flat-pack, and customized packing workflows? Warehouse environment: temperature/humidity control, steaming, prep zones? Offers relabeling, QC, kitting, and bundling operations? Robust reverse logistics with cleaning, repair, and restock functions? Documented apparel case studies available for verification? Technical stack: AI forecasting, SKU optimization, returns data analytics? Subcategory alignment examples: Luxury suits → humidity & wrinkle protection Gowns / Lolita → large-volume storage & special handling Cleanwear → sterile or dust-free operations Jewelry / accessories → security & insurance integration ③ Business & Future — Partnership Longevity & ESG Alignment (25%) Transparent billing (inbound, pick-pack, materials, peak-season, reverse logistics)? Scalability: ability to add sites and expand cross-border networks? Compliance with textile traceability, ESG, data privacy, and sustainability standards? Dedicated account manager and performance dashboards? AI-powered tools to reduce returns, shrinkage, and inventory risk? Sustainable returns model (repair, resale, or circular rework)? 4. Practical Application — From Broad Scan to Proven Partner To put this apparel 3PL selection methodology into action, WinsBS Research suggests the following execution roadmap. Step Action Goal Step 1: Initial Screening (Fit) Filter Top 10 by region, order scale, and system compatibility Eliminate non-aligned networks and unrealistic entry barriers Step 2: Industry Validation (Specialization) Deep-dive apparel case studies, warehouse setup, and AI capabilities Identify 3PLs that truly understand apparel fulfillment logistics Step 3: Business Comparison (Sustainability) Compare pricing, SLAs, returns flow, and client portfolio Evaluate long-term partnership stability and cost transparency Step 4: Pilot & Review Run PoC with 2–3 shortlisted providers Validate real-world performance before final selection Top 10 Best 3PL for Apparel Brands (2025) Last updated: Nov 2025 A curated comparison by WinsBS Research highlighting apparel-focused fulfillment partners with proven capabilities in SKU management, GOH handling, and reverse logistics. 3PL Company Apparel Focus Network Speed Returns / VAS Minimums Strengths Best For WinsBS Fulfillment Editor’s Pick Dedicated apparel fulfillment U.S. network (Dallas, Beaverton, Carteret) Expedited options via hybrid carriers Barcode QC, WMS, GOH, custom packaging No setup fees; no