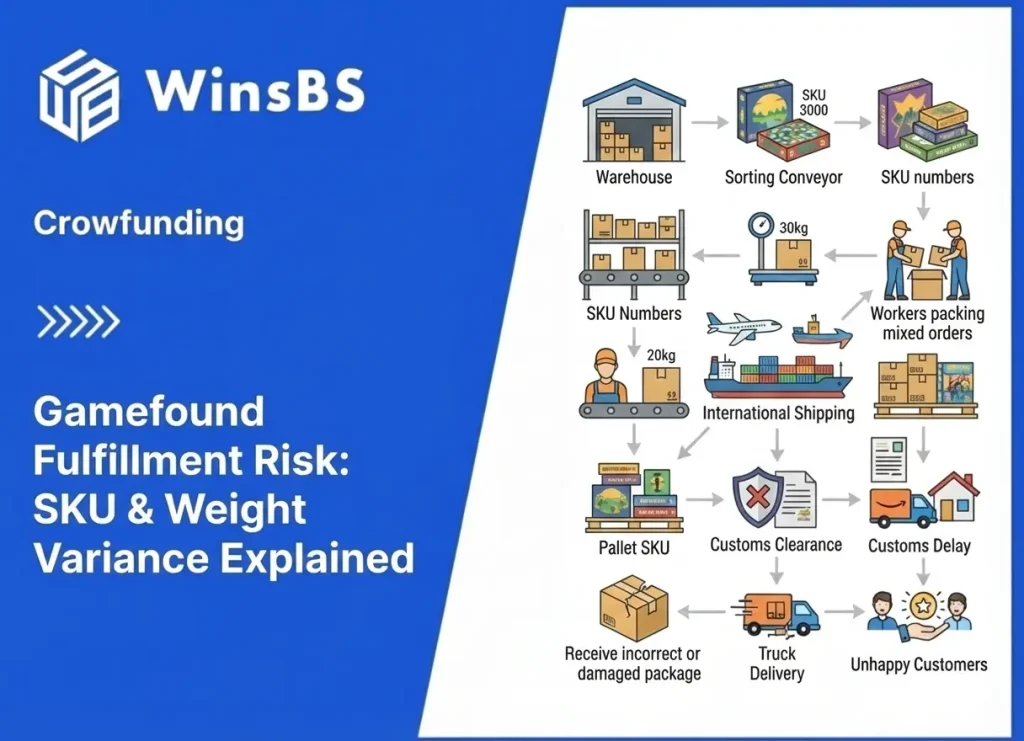

Gamefound Fulfillment Risk: SKU & Weight Variance Explained

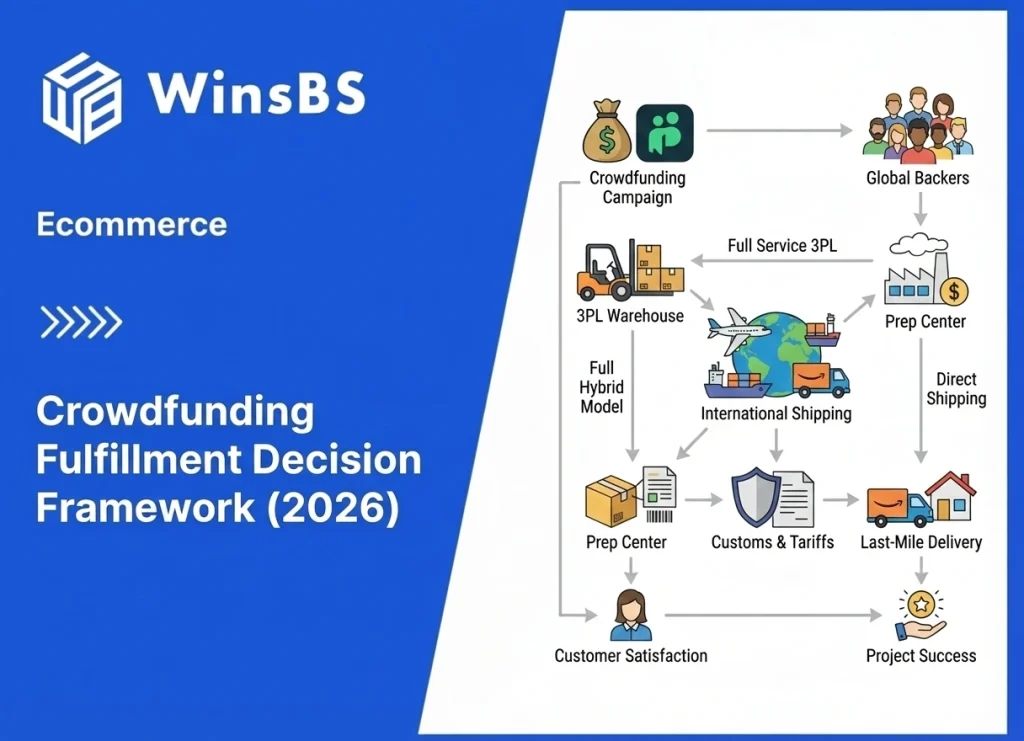

Gamefound Fulfillment: SKU & Weight Variance Risk Why unstable reward structures turn fulfillment models into structural failures Crowdfunding Fulfillment Risk Analysis · WinsBS Research Many Gamefound teams approach fulfillment planning as a downstream optimization problem. Once the campaign ends, attention shifts to carrier quotes, warehouse selection, and last-mile rates, with the assumption that execution efficiency will determine whether fulfillment succeeds or fails. What often goes unnoticed is that the most consequential constraints have already been set by the time teams start discussing carrier quotes and warehouse options. Fulfillment models are frequently locked while the physical reality of what must be shipped is still changing. This instability rarely announces itself early. Instead, it accumulates quietly and only becomes visible when costs spike, warehouse systems strain, or timelines slip. Where fulfillment risk actually begins In Gamefound campaigns, fulfillment risk does not originate with shipping distance, carrier selection, or warehouse performance. It begins earlier, with how rewards are structured and how those structures evolve after the campaign closes. In Gamefound campaigns, fulfillment risk originates from SKU structure rather than shipping distance, warehouse location, or carrier selection. Once pledges are finalized, teams quickly realize they are no longer shipping a single, stable product. Orders are composed of a base game combined with expansions, unlocked stretch-goal content, and optional add-ons selected independently by backers. Each order represents a different physical configuration. This is not an edge case. It is the normal operating condition of Gamefound fulfillment. Multiple SKUs per backer are not an exception in Gamefound campaigns but a structural default, making SKU composition inherently unstable before fulfillment execution. Professional fulfillment providers have repeatedly documented how this structure drives complexity. According to eFulfillment Service , unvetted stretch goals, excessive add-ons, and multi-SKU reward tiers are primary drivers of kitting errors, labor overruns, and late-stage cost escalation. The risk does not come from the number of SKUs alone. SKU quantity does not scale linearly with fulfillment complexity; SKU combinations created by tiers, add-ons, and stretch goals increase fulfillment variance exponentially. When fulfillment decisions are committed while this structure is still fluid, risk becomes embedded. Costs may appear controlled on spreadsheets, but they are anchored to assumptions that no longer reflect the eventual composition of real orders. This premature lock-in — committing to fulfillment models while key variables such as SKU composition are still fluid — is exactly the variance-driven failure pattern described in the Crowdfunding Fulfillment Decision Framework (2026) . How bundle expansion breaks weight assumptions Once SKU structure starts drifting, the impact does not stop at picking and packing logic. The next assumption to fail is almost always weight. Early in planning, teams often treat weight as a relatively stable input: estimate a box, estimate a unit weight, and scale from there. This approach only works if the bundle itself is already fixed. In practice, bundle composition continues to evolve well after early estimates are made. As add-ons are selected and stretch goals expand the contents of a pledge, packaging changes. Inserts, protection materials, and box dimensions shift to accommodate new configurations. Weight variance in Gamefound fulfillment is rarely a measurement error; it is a structural consequence of evolving bundle composition. Board games are particularly exposed to this dynamic because shipping costs are driven less by scale weight than by volume. As explained by PledgeBox , carriers charge by actual weight or dimensional weight, whichever is greater. When bundles grow, dimensional profiles change even if product weight does not. Add-ons and stretch goals structurally decouple package dimensions from base product weight, rendering early dimensional assumptions invalid by design. This variability is not hypothetical. LaunchBoom’s 2026 guidance on reward tier design makes this explicit: add-on selection and tier uptake cannot be reliably predicted before the campaign and pledge manager close . As a result, final bundle composition remains irreducibly variable until execution begins. Dimensional weight pricing causes parcels to be rated based on volumetric space rather than mass, making bundle composition drift a pricing variable rather than an estimation issue. When the pricing basis itself shifts, early weight models fail not because teams miscalculated, but because the underlying assumptions no longer apply. Why cost escalation appears late—and all at once One of the most damaging aspects of SKU and weight variance is timing. Early pricing models are typically built before real data exists on add-on uptake, final bundle composition, or geographic distribution of orders. Early fulfillment pricing models assume fixed SKU composition, weight, and dimensional profiles before actual bundle uptake is known. When those assumptions collide with finalized pledge data, costs rarely adjust smoothly. They jump. In examples documented by eFulfillment Service , unchecked SKU explosion and kitting instability directly created risks of $3,000–$4,500 labor overruns — risks that only became manageable after proactive intervention. When SKU composition and bundle structure evolve after assumptions are locked, fulfillment costs do not adjust incrementally; they escalate structurally. Repricing, zone-based rate shifts, and secondary handling requirements tend to surface together, not as isolated line items. Where fulfillment systems reach their limits Cost increases are only one visible symptom of structural mismatch. The same instability places stress on fulfillment systems themselves. Fulfillment systems are designed around stable SKU definitions, repeatable pick logic, and predictable inventory slotting. When every order represents a different combination of components, systems are forced to resolve constant exceptions. SKU variance breaks pick logic by replacing SKU-level handling with component-level decision paths that multiply exception states. Slotting assumptions fail for the same reason, increasing manual intervention and labor overhead even when execution teams perform competently. System failure under SKU variance reflects assumption mismatch rather than system quality or execution capability. The structural boundary: what can be known, and what must remain open SKU complexity and weight variance do not make analysis impossible. They simply define a clear boundary: some elements can be evaluated early, while others must remain flexible until the end. Reward structure can be mapped. SKU boundaries can be observed. Bundle composition patterns can be monitored as pledges accumulate. These activities increase clarity without