Is Cross-Border DTC Still Profitable After De Minimis?

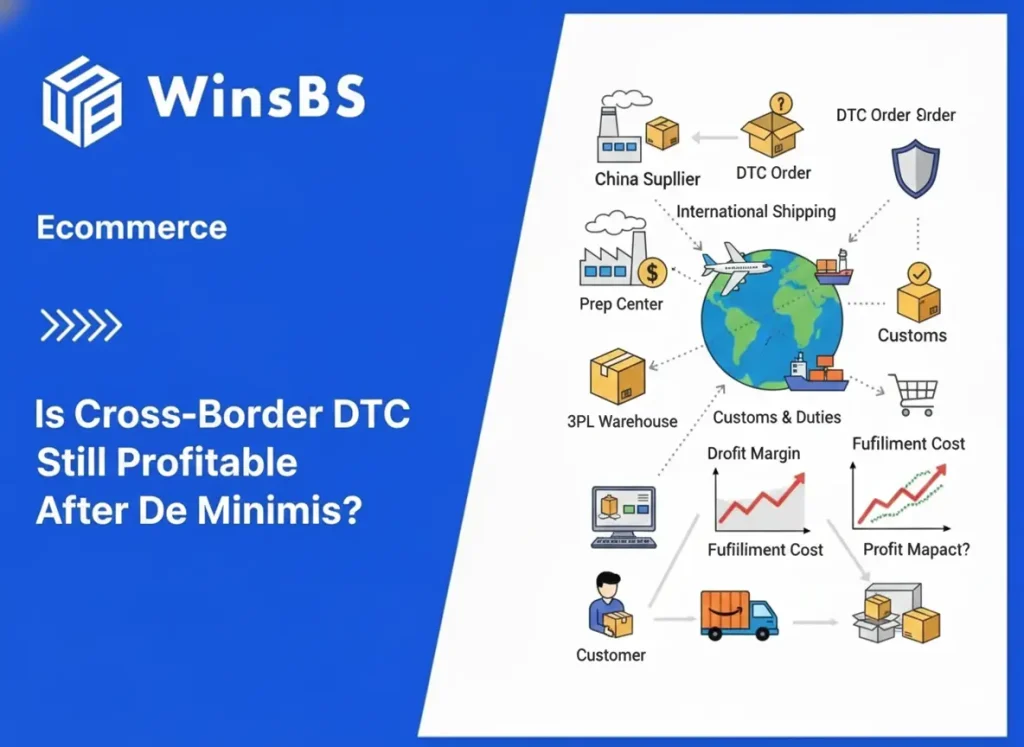

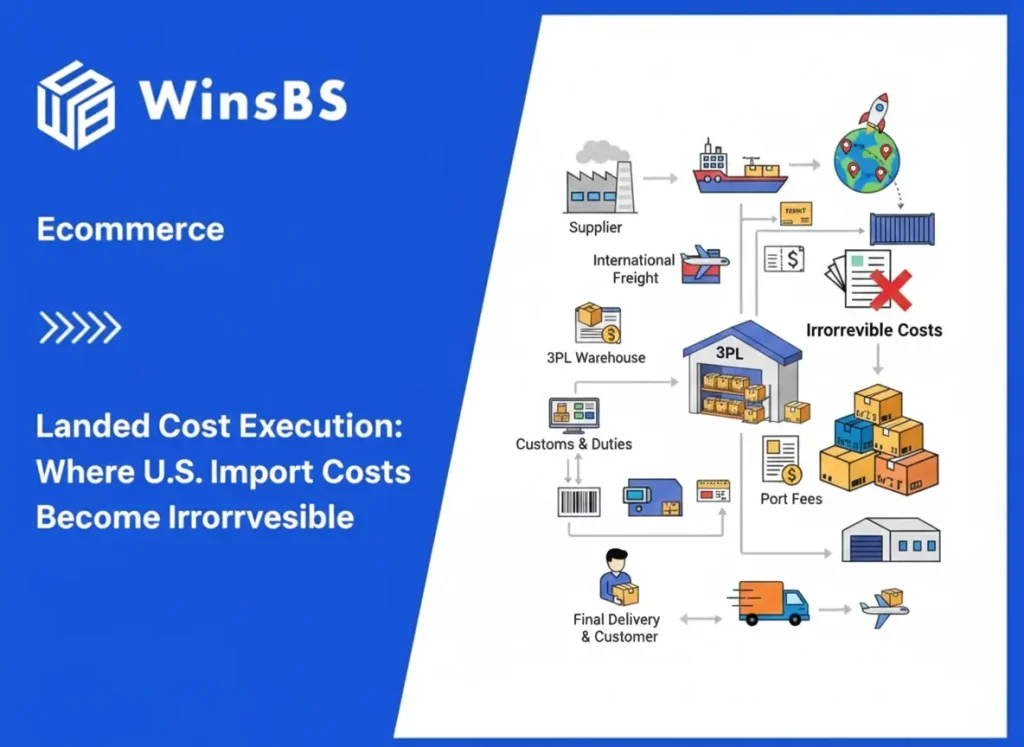

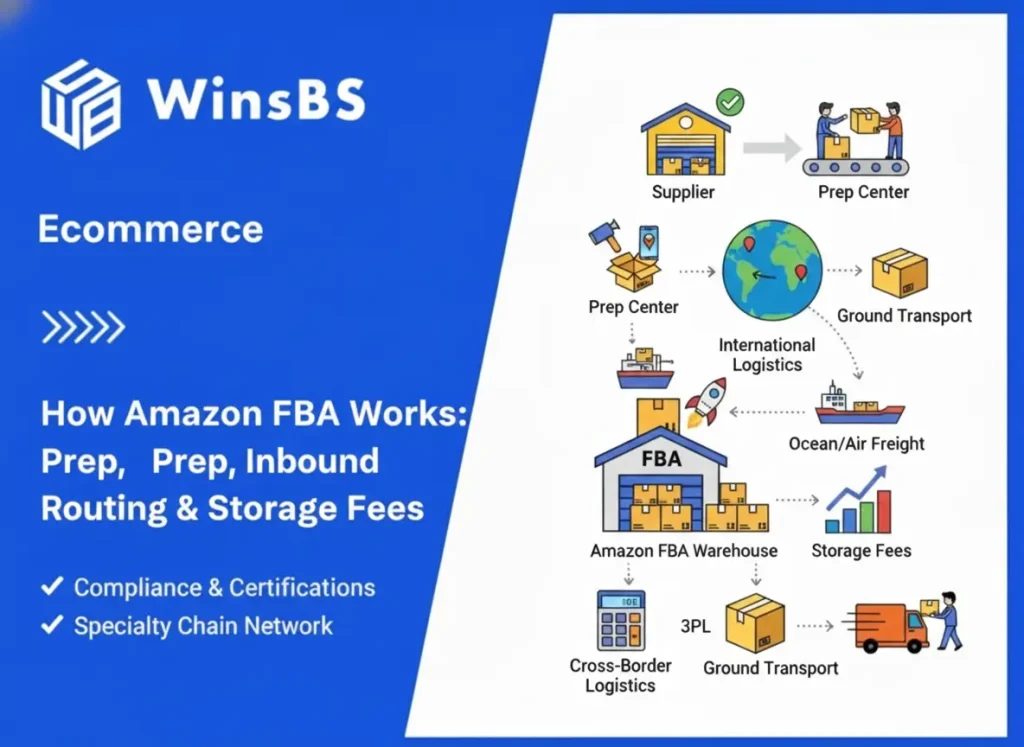

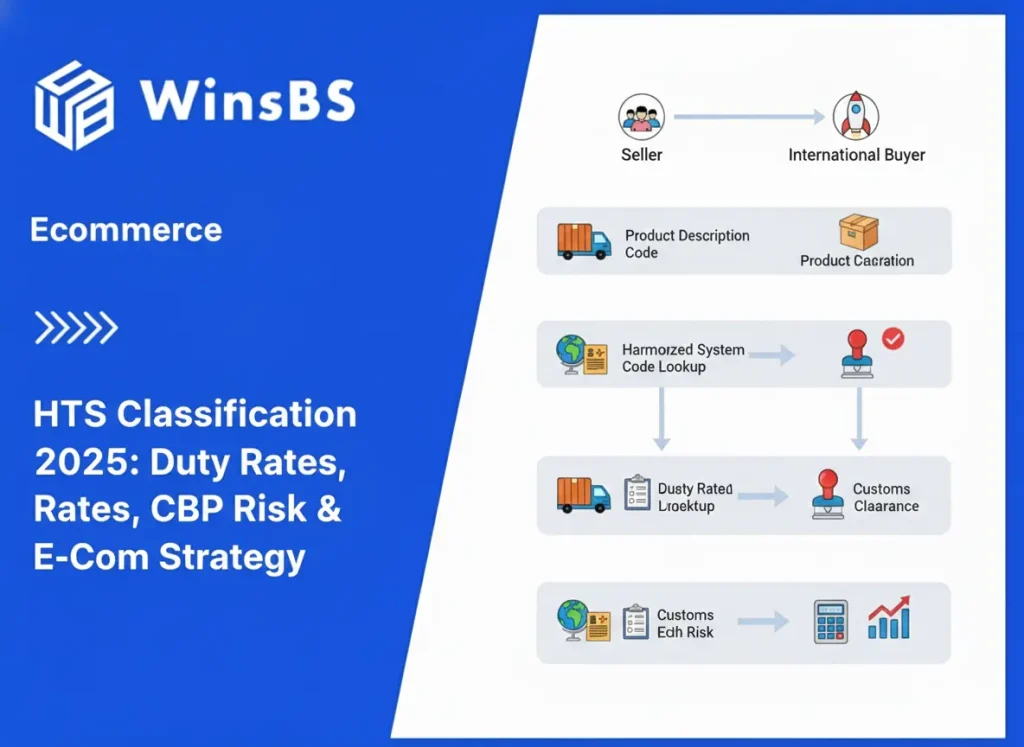

Is Cross-Border DTC Still Profitable After De Minimis? A 2025 Reality Check and 2026 Survival Guide for DTC and Shopify Brands WinsBS Research – Maxwell Anderson TL;DR — Five structural judgments you must understand: Cross-border DTC is not dead after U.S. de minimis and new tariffs, but the direct-ship-per-order model is no longer economically viable for low-AOV brands. If your average order value remains below $40–$50 in the U.S. or €30–€40 in Europe, fixed per-shipment costs now overwhelm gross margin. The primary profit killer is no longer shipping rates, but per-shipment brokerage and clearance fees, compounded in the EU by item-based customs charges. Brands that do not pre-collect duties at checkout are seeing higher refusal and return rates as customers reject surprise delivery charges. Local or bonded inventory combined with upfront duty collection is no longer an optimization—it is the minimum structural requirement to stabilize unit economics in 2026. Many sellers are misreading what actually changed. They look at collapsing margins and conclude that cross-border DTC demand has weakened, that paid acquisition has become inefficient, or that the market has simply “matured.” This is a misdiagnosis. What has changed is not demand. What has changed is the cost structure that sits underneath each individual order. Post–de minimis enforcement did not raise costs gradually. It introduced fixed, non-negotiable per-shipment charges that scale poorly against low average order values. The result is a profit cliff. Orders that once cleared margin thresholds now fall off abruptly, not because consumers stopped buying, but because fulfillment economics crossed a structural boundary. Read this as a decision guide, not a news recap. The goal is to determine whether your cross-border DTC unit economics still clear the post–de minimis viability boundary—and what minimum changes are required if they do not. Contents Is Cross-Border DTC Dead or Still Survivable? The Profit Cliff: Why AOV Is the First Death Line The U.S. Reality: Fixed Per-Shipment Costs as the Primary Killer The EU Reality: €3 Is Charged Per Item Type, Not Per Parcel Why This Is an Asymmetric Cost Disadvantage Against Local Sellers Operational Fallout: Refusals, Returns, and Rating Damage AOV Break-Even Calculator (Post–De Minimis) The Minimum Survival Architecture for Cross-Border DTC in 2026 Execution Checklist: How to Apply the AOV Boundary in Practice What Does Not Fix the Problem Why This Becomes a Fulfillment Decision, Not a Marketing One Next Steps for Brands Crossing the AOV Boundary When Fulfillment Architecture Becomes the Decision Content Attribution & Editorial Disclosure — WinsBS Research IS CROSS-BORDER DTC DEAD OR STILL SURVIVABLE? The short answer is no—cross-border DTC is not dead. But the model that powered its growth for the last decade no longer survives under post–de minimis enforcement. Cross-border DTC remains viable only when unit economics can absorb fixed per-shipment costs without collapsing margin. That condition is no longer true for the classic low-AOV, direct-ship-per-order model. For years, sellers relied on a structure where shipping, duties, and clearance scaled roughly in proportion to order value. When de minimis thresholds were broadly enforced, low-value orders could cross borders without triggering formal entry, brokerage, or itemized customs handling. That proportionality no longer exists. Post–de minimis enforcement introduces fixed costs that apply regardless of whether the order is worth $20 or $200. Once those fixed costs exceed gross margin, the business does not gradually degrade—it flips into loss. This is why many sellers experience the change as sudden and confusing. Demand often remains stable. Conversion rates may not collapse. But profitability disappears at the order level. In other words, cross-border DTC did not die. A specific economic configuration died. THE PROFIT CLIFF: WHY AOV IS THE FIRST DEATH LINE The most important variable in post–de minimis cross-border DTC is average order value. Not conversion rate. Not shipping speed. Not marketing efficiency. Average order value determines whether fixed per-shipment costs behave like a tolerable tax or a fatal burden. When AOV remains consistently below $40–50 in the United States or €30–40 in Europe, cross-border DTC becomes structurally unprofitable unless major changes are introduced. This is not a pricing opinion. It is a mathematical boundary. Fixed clearance, brokerage, and processing fees do not scale down for small baskets. They apply per shipment, not per dollar of revenue. Below this AOV range, each order must absorb a similar fixed cost while generating less gross profit. Once that fixed cost exceeds contribution margin, bundling, discounts, and shipping optimization can no longer repair the equation. This creates a profit cliff rather than a slope. Orders do not become “less profitable.” They cross into guaranteed loss territory. Many brands continue shipping because top-line revenue still appears healthy. But at the unit level, every fulfilled order accelerates margin erosion. This is why AOV must be evaluated before any discussion of tactics, fulfillment partners, or logistics optimization. If the order value sits below the cliff, no downstream fix can restore profitability. Figure 1: Cross-Border DTC Profit Cliff After De Minimis (2025–2026) High Margin Break-even Loss $20 $30 $40 $50 $60+ Fixed per-shipment costs ($25–$45) Profit Cliff Zone $40–$50 AOV threshold AOV Profit Cliff Visualization Fixed brokerage, clearance, and duty costs create a hard profitability floor. Below approximately $40–$50 average order value, net margin per order remains structurally negative regardless of shipping optimization or gross margin percentage. The curve illustrates how margin only stabilizes once order value clears the fixed-cost boundary. THE U.S. REALITY: FIXED PER-SHIPMENT COSTS AS THE PRIMARY KILLER One of the most common misdiagnoses is blaming shipping rates. Sellers see higher landed costs and assume that parcel carriers or linehaul pricing are the main drivers of margin collapse. In reality, shipping rates are no longer the dominant factor. In the United States, the primary profit killer after de minimis enforcement is fixed per-shipment brokerage and clearance cost. These costs typically range from $20 to $50 per shipment, depending on entry type, carrier handling, and compliance requirements. Crucially, these fees apply regardless of order value. A $22 order and a $220 order incur similar clearance overhead. For low-AOV brands, brokerage alone