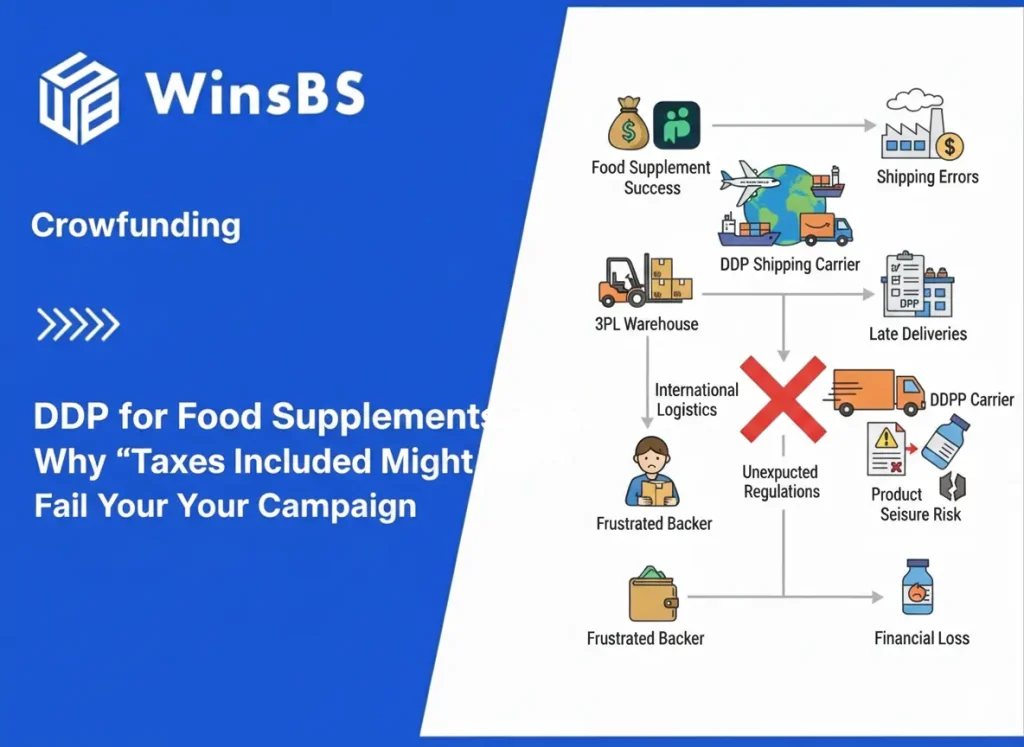

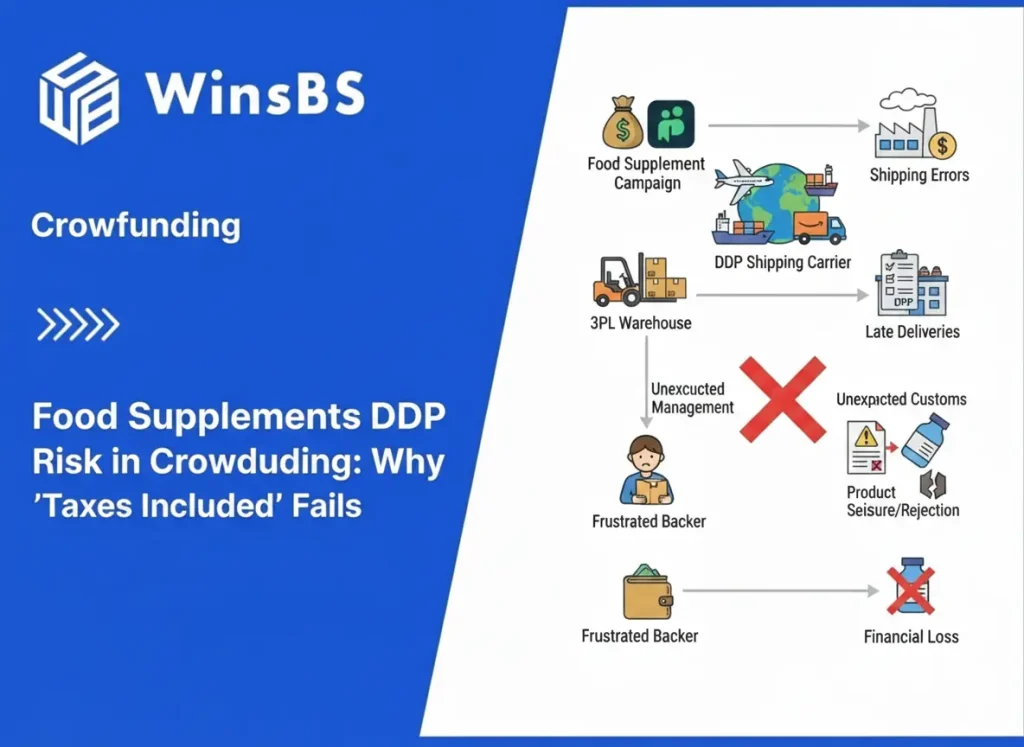

DDP for Food Supplements 2026: Why “Taxes Included” Might Fail Your Campaign

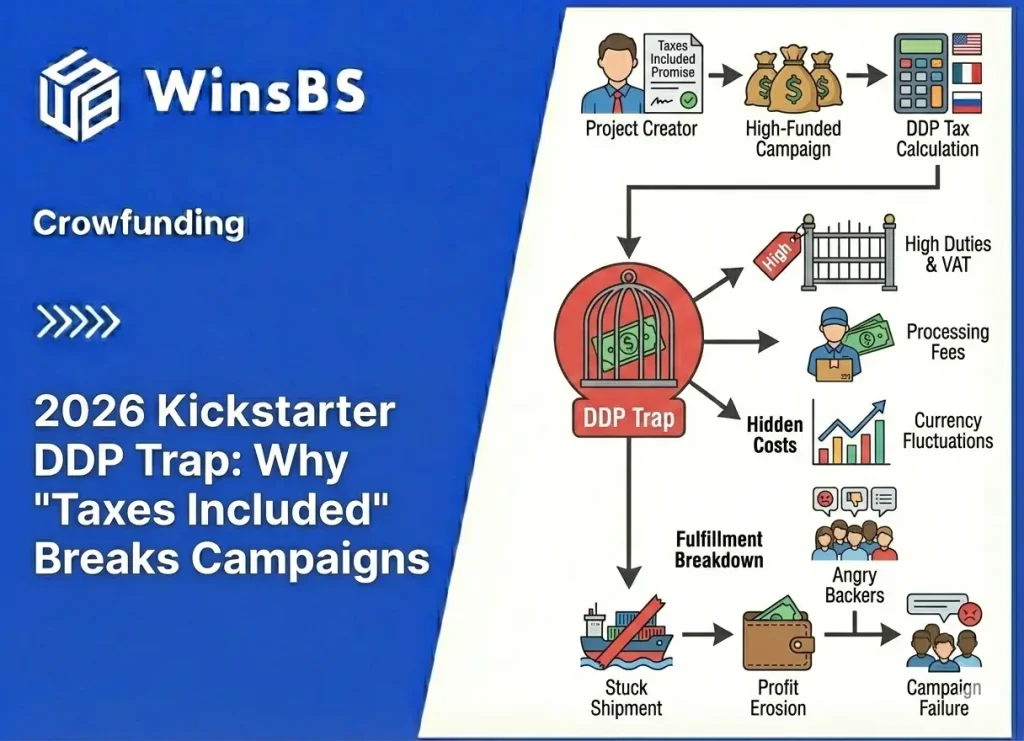

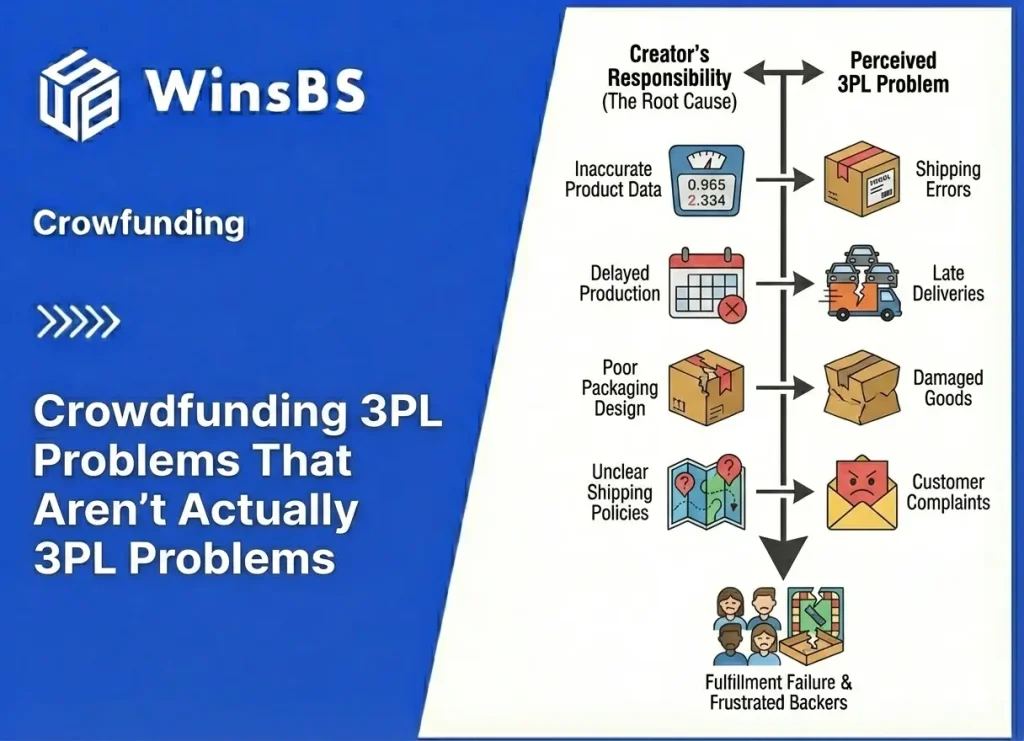

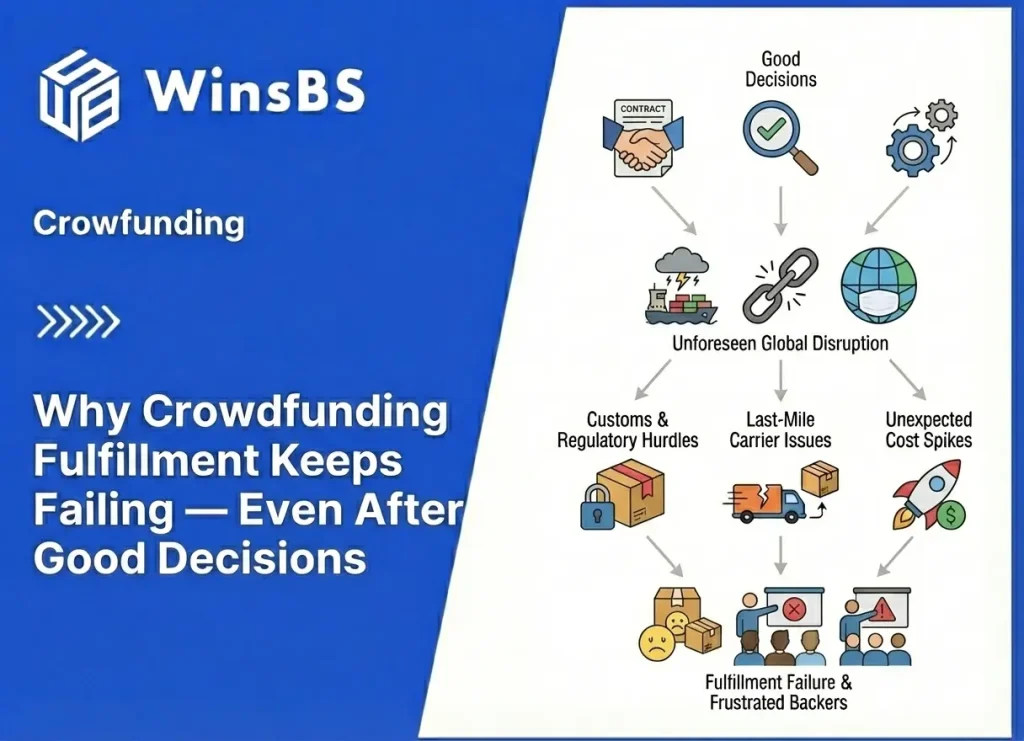

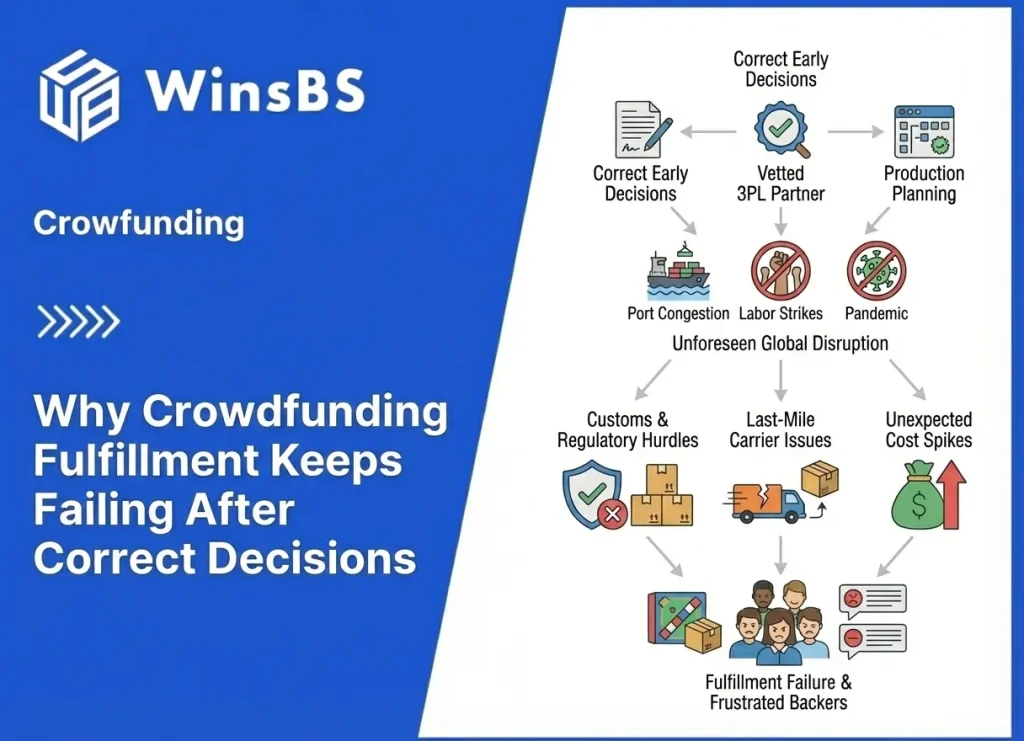

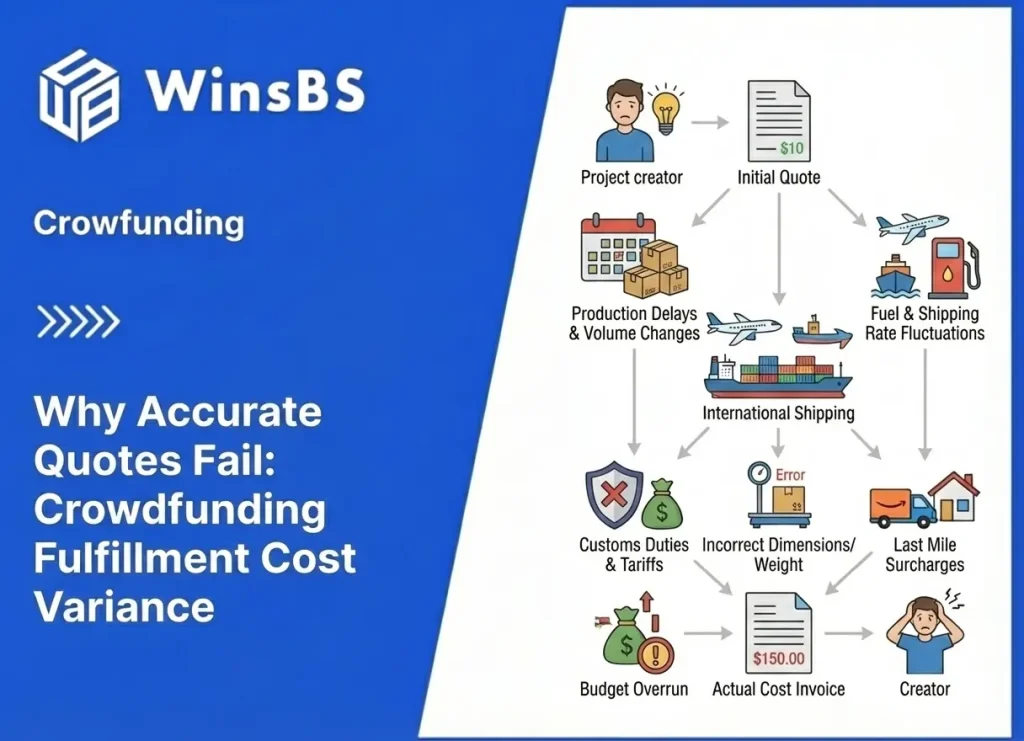

DDP for Crowdfunding Food Supplements 2026: How It Works, Where It Breaks, and Why “Taxes Included” Can Collapse Regulatory Sequencing, Importer Responsibility, Novel Food/Claims Triggers, and Practical Risk Controls WinsBS Fulfillment – Maxwell Anderson Updated January 23, 2026 Table of Contents Why Food Supplement DDP Gets Misunderstood What DDP Actually Does (and Does Not Do) for Supplements Regulatory Sequencing: Why Supplements Are Judged Before They’re Taxed Responsibility Under DDP: What Never Transfers What Happens When Supplement DDP Fails Country Differences: What Each Market “Looks For” First Formula & Claims Risk: Why “Small Changes” Become Big Regulatory Events When DDP Becomes Predictable (Narrow Conditions) When Risk Comes From the Promise, Not the Shipment 5-Point DDP Safety Checklist A Practical Way to Think About DDP for Supplements Most creators treat DDP as a billing decision: “I’ll pay duties and taxes so backers don’t get surprised.” That framing works for many consumer product shipments where clearance is dominated by valuation, classification, and paperwork. Food supplements behave differently because customs is only one gate. The other gate is permission: is this product allowed to enter the market as a food supplement at all? Here’s the simplest translation of the risk: DDP pays the bill, but it doesn’t open the gate. For food supplements, the gate is regulatory permission—not customs payment. This is why two shipments can share the same DDP term and the same carrier, yet diverge completely at the border. For supplements, regulators evaluate ingredients, claims, and labeling early. In the U.S., that “permission layer” starts as early as FDA Prior Notice, which exists so FDA (with CBP support) can target import inspections. In the EU, “permission” can include whether an ingredient falls under the Novel Foods Regulation (EU) 2015/2283 before it can be placed on the market. What DDP Actually Does (and Does Not Do) for Supplements DDP can clean up the backer experience. Duties and taxes get prepaid, so the package doesn’t arrive with a surprise bill. That matters in crowdfunding because the first public complaints are never about tariff schedules. They’re about broken expectations: “You said taxes included.” The most important correction is this: prepaid duties do not convert an uncertain supplement into an accepted supplement. DDP affects who pays and how charges are collected. It does not change how regulators decide admissibility. DDP can make the money side smoother after acceptance—but it cannot make acceptance happen. Bottom line: For supplements, DDP is an experience tool built on top of regulatory permission. If the permission layer is unstable, DDP doesn’t reduce uncertainty—it makes the consequences of uncertainty arrive later and more publicly. Regulatory Sequencing: Why Supplements Are Judged Before They’re Taxed If you sell a gadget, many “bad outcomes” still look like delivery: higher landed cost, brokerage, or a reclassification dispute. If you sell a supplement, many “bad outcomes” look like non-delivery because regulators treat supplements as products that can mislead or harm consumers if composition or claims are wrong. In the U.S., Prior Notice is not a “nice-to-have.” FDA describes Prior Notice as a required advance notification for imported foods, designed to support targeted inspection and food supply protection. The operational impact is simple: the system expects accurate notice and consistent shipment details before “DDP” has any chance to behave the way creators imagine. If you want the procedural anchor, FDA’s “Filing Prior Notice” page explicitly ties Prior Notice to 21 CFR Part 1, Subpart I and explains submission routes. In the EU, the sequence is even more visible. The European Commission’s own “Food supplements” overview places supplements inside a defined policy framework tied to Directive 2002/46/EC. And where an ingredient is treated as “novel,” the Novel Foods Regulation requires authorization pathways before market placement. That means a “taxes included” promise can be financially accurate and still operationally wrong, because the first gate is not the tax bill—it’s whether the product definition is accepted. Bottom line: Supplements do not clear like general merchandise. They clear through a permission-first sequence. DDP sits after that sequence, not before it. A Common Crowdfunding Failure Pattern (Supplements) A creator launches with a formula that looks straightforward on a product page. During the pledge manager, the team adds an “improved” blend and stronger benefit copy. The shipping quote doesn’t change. The campaign still says “Taxes Included.” Then the shipment is evaluated as a supplement product with composition + claims questions. In the EU, the framework that constrains health-related claims is Regulation (EC) No 1924/2006, and the Commission maintains an EU Register of nutrition and health claims used to verify what’s permitted and under what conditions. In the U.S., FDA’s industry pages describe the notification expectations for structure/function and related claims under section 403(r)(6) and how those claims should be substantiated. The point is operational: your campaign promise was priced on a shipping variable. Your shipment is being judged on a regulatory variable. Those two variables do not move together. Responsibility Under DDP: What Never Transfers DDP is often interpreted as “the carrier takes it from here.” For supplements, that mental model breaks fast. Regulators attach responsibility to the importer and the party placing products on the market—not to the payment method. If you want a concrete, non-theoretical statement of this responsibility framing, the UK Food Standards Agency guidance on importing food supplements and health foods is written for businesses and focuses on what importers must watch for (labelling, contaminants, and category boundaries). “DDP” does not erase any of that responsibility. It simply changes how duties and taxes are paid once the product is permitted through the relevant gates. Bottom line: Under DDP, responsibility doesn’t disappear. It becomes more concentrated—because you’ve paired a public promise (“no surprises”) with a system that may stop a shipment for reasons unrelated to payment. What Happens When Supplement DDP Fails When supplement DDP fails, it typically fails through a small number of repeatable system behaviors. Not because every country is identical, but because regulators tend to act on the same inputs: ingredients, claims, labeling, and importer accountability. In